Statistics

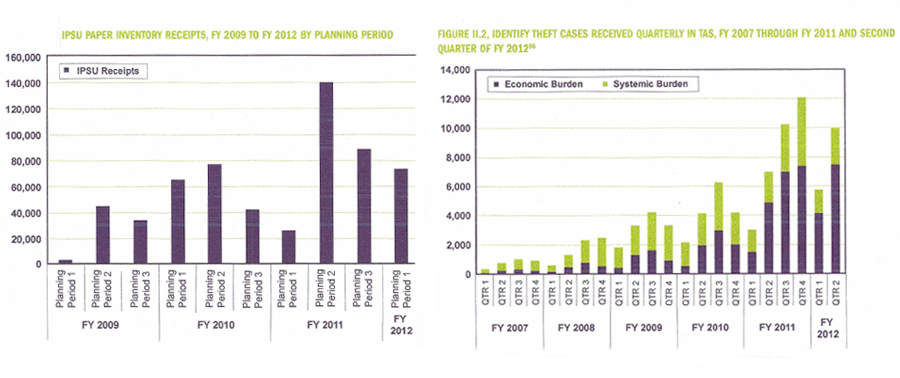

Today, identity theft can be an organized, large-scale operation. Indeed, the most recent IRS data show more than 450,000 identity theft cases service wide. The Identity Protection Specialized Unit (IPSU), the centralized IRS organization established in 2008 to assist identity theft victims, is experiencing unprecedented levels of case receipts. As the first chart below shows, IPSU receipts have increased substantially over the two previous years.

The Taxpayer Advocate Service has experienced a similar surge in cases, as TAS identity theft receipts rose 93 percent in fiscal year (FY) 2011 over FY 2010. The upward trend continued in the first two quarters of FY 2012, when TAS received nearly 16,000 identity theft cases, a 57 percent increase over the same period in FY 2011. The growth in casework reflects the both the increase in identity theft incidents and the IRS’s inability to address the victims’ tax issues promptly. Please see the second chart below.

The Government Accountability Office (GAO) recently prepared a report on November 29, 2012 titled, Identity Theft, Total Extent of Refund Fraud Using Stolen Identities is Unknown. This report found, among other things, that the IRS does not know the full extent of the occurrence of identity theft. While the IRS has made significant efforts to resolve, detect, and prevent identity theft-based fraud, the problem still exists and is continuing to grow.

According to the GAO’s report, as of September 30, 2012, the IRS had identified almost 642,000 incidents of identity theft that impacted tax administration in 2012, a significant increase over prior years. This figure did not include incidents related to the “Operation Mass Mail” scheme in which identity thieves used stolen identities of Puerto Rican citizens. The IRS reported that as of September 30, 2012 436,000 incidents occurred as a result of this scheme.

In the table below, tax-related identity theft incidents, identified by the IRS between 2008 and 2012, show that the problem is a large and growing one. In fact, as you will see it more than doubled between 2011 and 2012.

| Incidents | |

| 2008 | 47,730 |

| 2009 | 165,524 |

| 2010 | 147,680 |

| 2011 | 242,142 |

| 2012 | 641,690 |

The GAO report acknowledged that the IRS has taken multiple steps to detect, resolve, and prevent identity-theft based tax refund fraud. For example, new filtering processes in 2012 were implemented which detect identity theft based on the characteristics of incoming tax returns. The IRS also uses the Identity Protection Personal Identification Number (IP PIN), sent to victims of identity theft.

However, while these and other tools are necessary in the ongoing war on identity-theft based tax refund fraud, it is the position of the Committee For Efficient Government (CFEG) that it is absolutely critical that the IRS commit and allocate most, if not all, existing and available resources now (including IRS personnel) to prevent identity theft-based tax refund fraud between the months of January, 2013 and April, 2013. This period represents the height of the 2013 tax season and most incidents of identity theft-based tax refund fraud will occur during this period of time.

The number of tax-related identity theft incidents has increased substantially in recent years. Within TAS, identity theft case receipts increased by more than 650 percent from FY 2008 to FY 2012. At the end of FY 2012, the IRS had almost 650,000 identity-theft cases in its inventory servicewide. The problem has grown worse as organized criminal actors have found ways to steal the Social Security numbers (SSNs) of taxpayers, file tax returns using those taxpayers’ names and SSNs, and obtain fraudulent tax refunds. Then, when the real taxpayer files a return claiming the refund, that return is rejected. The impact on victims is significant. More than 75 percent of taxpayers filing returns are due refunds, which average some $3,000 and are not paid until the IRS fully resolves a case.

IRS Commitments. In 2008, the IRS Commissioner testified about identity theft before a Senate Finance Committee hearing. He stated: “My overall goal as the IRS Commissioner is that when a taxpayer [who is an identity theft victim] contacts us with an issue or concern, we have in place a seamless process that gets the issue resolved promptly.” Later that year, the IRS established an “Identity Protection Specialized Unit” (or “IPSU”), which was designed to provide centralized assistance to victims of identity theft. The National Taxpayer Advocate supported the commitment to centralized and prompt victim assistance.

IRS Performance. The report says the IRS has created numerous task forces and other teams in recent years in an attempt to improve its identity theft processes, yet victims still face the same “labyrinth of procedures and drawn-out timeframes for resolution” that they faced five years ago. The IRS is instructing its employees to advise identity theft victims that it will take 180 days – half a year – to resolve their cases. Complicated cases inevitably will take longer. Thus, the IRS’s procedural changes are not providing faster relief.

The report also says the IRS has decided to reverse course and decentralize victim assistance. It recently created specialized units within each of 21 individual functions to work on identity theft cases, apparently under the belief that most identity theft cases involve a single issue that the relevant specialized unit can work most efficiently. The report expresses concern about this backtracking from a centralized approach.

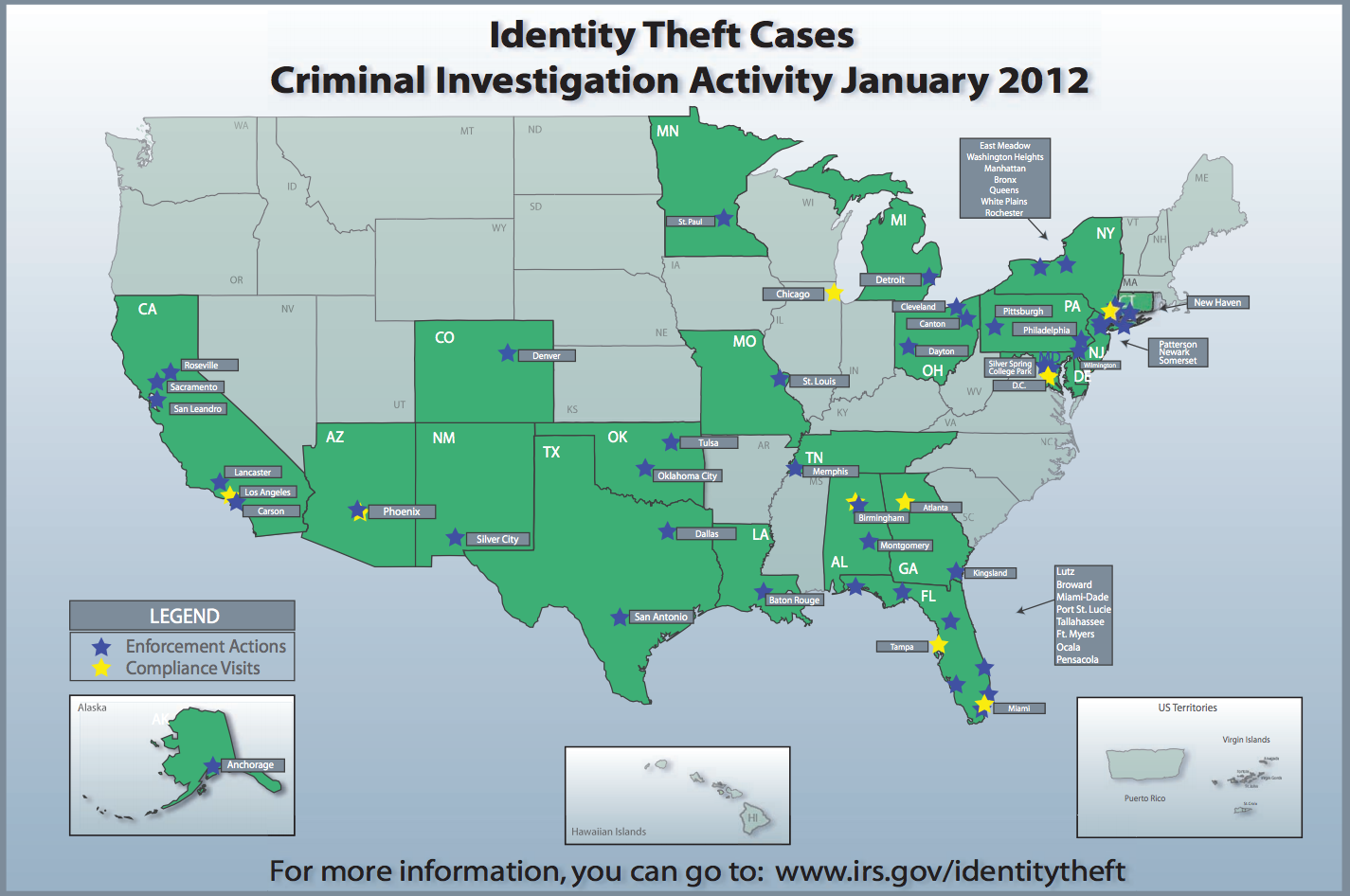

Identity Theft Cases

Below is a recent update by the IRS which shows how far they have come since Representatives Castor, Nugent and Tampa Bay area law enforcement officials began pressing for change. Beth Tucker, IRS Deputy Commissioner for Operations Support, advised Rep. Castor that the IRS has made identity theft and fraudulent tax returns a top priority. Below are some statistics regarding improvements in enforcement and prevention as a result of administrative action:

Statistics on Enforcement

- Increases from 2011 to 2012

- 70% increase in investigations

- 60% increase in cases recommended for prosecution

- 67% increase in prosecutions

- 223 people sentenced in 2012 versus 80 in 2011

- Task Force pilot program working to share information across all levels of law enforcement

- Waiver program allows tax payers to release information to be used in law enforcement investigations

- Program expanded to New York, New Jersey, Pennsylvania, Georgia, Alabama, Texas, Oklahoma, California

Statistics on Prevention

- 770,000 PINs issued for previous victims (up from 250,00 in 2011)

- Extra layer of protection for taxpayers to prevent anyone from filing a return using their social security number unless they have this unique PIN

- New screens to flag possible fraudulent returns for further investigation

- Multiple returns to same bank account

- Multiple returns to same mailing address

- Excessive or inconsistent claiming of tax credits

- IRS working with state departments of revenue

- Study to determine if earlier data acquisition will lead to prevention

- Example: Compare actual W-2 information sent to taxpayer with information used on return

- Can also help taxpayers catch honest mistakes earlier and avoid fines

Rep. Castor stated, “We will continue to press the IRS to stop the issuance of fraudulent returns and file our Tax Crime and Identity Theft Prevention Act as our first bill this congress.”

While Rep. Castor applauded the improvements and administrative actions taken by the IRS she said, “we must not lose any momentum or leave our local law enforcement without the tools and backup they need.”