IRS FOIA Documents

Data on Back Taxes Owed and Delinquency Rates of Federal Employees

CFEG reports that it received information from the IRS pursuant to a FOIA request on March 30, 2015 seeking data pertaining to the amount owed by federal employees and retirees in unpaid taxes, the number of federal employees and retirees with unpaid taxes, the delinquency rates of federal employees and…

Back Taxes Owed By Federal Employees

CFEG reports that it received information from the IRS pursuant to a FOIA request on February 23, 2015, seeking data and reports pertaining to the number of IRS employees who were terminated or disciplined for failing to file federal tax returns and for understating their federal tax liability as well…

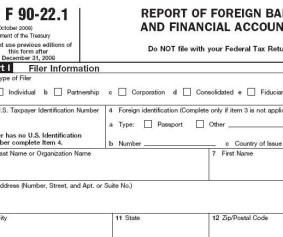

IRS Report of Foreign Bank and Financial Accounts (FBAR)

CFEG reports that it recently obtained the information below pursuant an order entered by the U.S. District Court for the District of Columbia where the IRS is producing documents on a monthly basis in response to Freedom of Information Act (FOIA) requests. The information may be helpful to taxpayers who may be required…

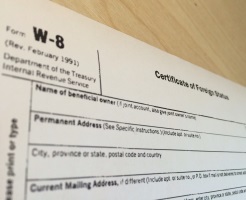

IRS W-8 Forms

CFEG reports that it recently obtained e-mails pursuant to an order entered by the U.S. District Court for the District of Columbia where the IRS is producing documents on a monthly basis in response to Freedom of Information Act (FOIA) requests submitted by CFEG. These FOIAs requested records reflecting how Form W-8EXP (Certificate of…