Media Articles

Income credit claims will continue to go unaddressed each year

TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION WITHOUT EXPANDED ERROR CORRECTION AUTHORITY, BILLIONS OF DOLLARS IN IDENTIFIED POTENTIALLY ERRONEOUS EARNED INCOME CREDIT CLAIMS WILL CONTINUE TO GO UNADDRESSED EACH YEAR Final Report issued on April 27, 2016 CFEG reports that the Treasury Inspector General For Tax Administration (TIGTA) issued a final…

Review of the internal revenue service’s purchase card violations report

TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION REVIEW OF THE INTERNAL REVENUE SERVICE’S PURCHASE CARD VIOLATIONS REPORT Final Report issued on July 15, 2016 CFEG reports that on July 15, 2016 the Treasury Inspector General For Tax Administration (TIGTA) released a report of its Audit of the IRS’s Purchase Card Violations….

Significant improvments are needed in the contractor tax check process

TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION Office of Audit SIGNIFICANT IMPROVEMENTS ARE NEEDED IN THE CONTRACTOR TAX CHECK PROCESS Final Report issued on July 20, 2016 CFEG reports that TIGTA issued a report on July 20, 2016 finding that the IRS needs to make significant improvements in checking to see…

New Documents Suggest IRS’s Lerner Likely Broke the Law

From National Review Online 2016 by Eliana Johnson June 29, 2016 4:00 AM @elianayjohnson Recently obtained documents raise new questions about Lois Lerner’s role in sending confidential tax returns to the Justice Department. It is likely the largest unauthorized disclosure of tax-return information in history: the transfer of some 1.25…

The Internal Revenue Service Did Not Identify and Assist All Individuals Potentially Affected by the Get Transcript Application Data Breach

CFEG reports that on June 8, 2016 the Treasury Inspector General for Tax Administration (TIGTA) released a report to the public which found that the IRS did not identify and assist all individuals potentially affected by the ‘Get Transcript’ application data breach in May, 2015 and whose tax information was…

Data on Back Taxes Owed and Delinquency Rates of Federal Employees

CFEG reports that it received information from the IRS pursuant to a FOIA request on March 30, 2015 seeking data pertaining to the amount owed by federal employees and retirees in unpaid taxes, the number of federal employees and retirees with unpaid taxes, the delinquency rates of federal employees and…

Back Taxes Owed By Federal Employees

CFEG reports that it received information from the IRS pursuant to a FOIA request on February 23, 2015, seeking data and reports pertaining to the number of IRS employees who were terminated or disciplined for failing to file federal tax returns and for understating their federal tax liability as well…

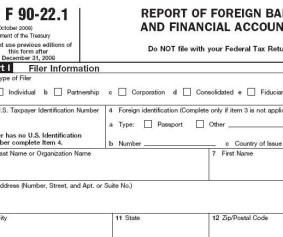

IRS Report of Foreign Bank and Financial Accounts (FBAR)

CFEG reports that it recently obtained the information below pursuant an order entered by the U.S. District Court for the District of Columbia where the IRS is producing documents on a monthly basis in response to Freedom of Information Act (FOIA) requests. The information may be helpful to taxpayers who may be required…

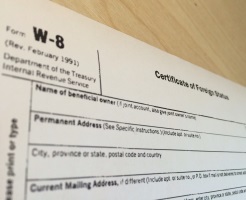

IRS W-8 Forms

CFEG reports that it recently obtained e-mails pursuant to an order entered by the U.S. District Court for the District of Columbia where the IRS is producing documents on a monthly basis in response to Freedom of Information Act (FOIA) requests submitted by CFEG. These FOIAs requested records reflecting how Form W-8EXP (Certificate of…

IRS Security Summit 2016

CFEG reports that the IRS, the states and the tax industry first came together in November 2015 and has continued in 2016 to identify even more safeguards to protect taxpayers’ federal and state tax accounts from identity thieves. CFEG has provided links which explains what the IRS has been doing in…

IRS Launches More Rigorous e-Authentication Process and Get Transcript Online

IRS Launches More Rigorous e-Authentication Process and Get Transcript Online WASHINGTON — With the assistance of top digital experts at U.S. Digital Service and other security authorities, the Internal Revenue Service today launched a more rigorous e-authentication process for taxpayers that will significantly increase protection against identity thieves impersonating…

The IRS Scandal, Day 1128

The Hill, House Panel Votes to Cut IRS Funding: The House Appropriations Committee on Thursday approved a spending bill that would reduce funding for the Internal Revenue Service (IRS). The bill would give the IRS $10.9 billion for fiscal 2017, which is $236 million less than the enacted level for…